Moving to Spain from the UK and buying a property

Buying a new home is one of the most stressful endeavors when moving to Spain. British expats may be surprised by how different and bureaucratic the process is in Spain compared to the UK. So getting it right is essential to your long-term residency goals (especially if you’re considering the Golden Visa. More on that below).

Many people buy a second home in Spain to rent out as holiday accommodation. But what about taxes/duties?

There’s a lot to consider which we cover in detail here: What do you need to move to Spain from UK?

The purpose of this article is to give you a brief synopsis of the above. Below you’ll find an overview of what you need to know about moving to Spain from the UK and buying a property.

Checklist of requirements needed to move to Spain from the UK

Here are some essentials you need to get things underway in Spain:

- Aquire an NIE, a Spanish identification number for foreigners. There are several ways of getting an NIE: You can apply for it at your local Spanish consulate, you can apply at an immigration office in Spain or, as often the case since December 31, 2020, you get your NIE when approved for a Spanish residency visa (we cover the various visa options further below).

- Validate your Passport and Driver’s license. Make sure they’re up to date. You’re allowed using your British driver’s license for 6 months in Spain before having to apply for a Spanish license.

- Register your Spanish address. You do this at the town hall of the municipality where you’re moving. You’ll get a “padrón”, a certificate that is official proof of where you live in Spain (very important for lots of Spanish paperwork).

- Reinvestment exemption when selling your primary residence overseas. It is important to file this tax exemption so that you don’t pay Spanish taxes on the sale of your property. More here.

- Advise the British Healthcare system. It is mandatory to leave the NHS when moving permanently to Spain.

- Open a Spanish bank account. You’ll usually need an NIE, passport and personal and financial information.

- Apply for your residence permit once you get to Spain. You have 30 days to apply for your residency card once you’ve entered Spain with your visa (your residency card is the TIE “Tarjeta de Identidad de Extranjero”)

A few useful Resources

Buying Private health insurance in Spain. We recommend Innoinsure, they make it easy and offer different policies through various providers. And you don’t need a Spanish bank account – you can pay with foreign credit cards. More info here.

Spartan FX. Buying a house or car in Spain and need to transfer and exchange a large sum of money? More here.

Wise. For everyday transfers and exchanges of money from your home country. Nobody should be using banks anymore. More here.

Visa options for British Citizens

Since 1st January 2021, the United Kingdom has now been considered a third state which has changed the laws for British citizens wanting to reside in Spain.

Want to move and live in Spain? Here are the most common Visa options:

Golden Visa

As a component of the Law of Entrepreneurs, the Golden Visa promotes investment in Spain in exchange for Spanish residency. This visa allows the buyer and their families to live in Spain as long as they invest at least €500,000 in real estate. As mentioned at the top, it is important to make sure that all property purchases are done in proper fashion in order to qualify for this visa.

The Golden Visa has some generous advantages: approved applicants can work in Spain, they can have residency in Spain with little in-country time requirements, applicants are fast-tracked and can get residency within 20 working days from the date of application.

The Non-Lucrative Residence Visa

This kind of visa permits stays in Spain longer than ninety days, however, it does not permit engaging in professional work. You must provide proof that you have enough money to fund your stay in Spain to apply for this visa (most people applying for this visa are retirees). Like the Golden Visa, you can renew the Visa and after 5 years obtain permanent residency.

More on the Non-Lucrative Residence Visa

Digital Nomad Visa

Digital nomads are people who work from home or remotely. An advantage of the Digital Nomad Visa is a reduced tax rate: the Beckham Law reduces your tax rate to 24% on your first 600,000 Euros in Income (which is much less than the tax rate that applies to Spanish residents). You can qualify for a Digital Nomad Visa if…

- You’re a freelance online worker.

- You’re a digital nomad that works for an employer.

More on the Digital Nomad Visa

Note: If you were residing in Spain before 31 December 2020 but don’t have a European Union citizen’s enrollment instrument or TIE card, you’re allowed to continue to live in Spain…but you must prove that you have been an occupant in Spain since before that date.

Tax Residence in Spain

As you’ll be living permanently in Spain, you’ll need to pay your taxes/duties as a Spanish resident. Composition 9 of the Personal Tax Income Law states that if an individual resides in Spain for more than 183 days, or whose primary fiscal interests are located in Spain, they must become a tax resident of Spain.

Income duty (IRPF) – Model 100. Your worldwide income will be taxed in Spain (rental inflows, dividends, capital earnings, etc.). To avoid double taxation, you must ensure that a double-taxation agreement is inked between Spain and your country of origin.

Protestation of means – Form 720. All individualities and legal realities must complete a 720 form to declare holdings outside of Spain that exceed € 50,000. This is meant as a control over potential tax evasion.

Moving to Spain from the UK

The team at Tejada Solicitors are experts in property conveyancing. They will advise you from start to finish, covering every aspect of the conveyancing process. They cover all paperwork and secure your interests, covering you for all legalities, paperwork and all the tax implications involved in buying a home in Spain.

Related: The best things about living in Spain

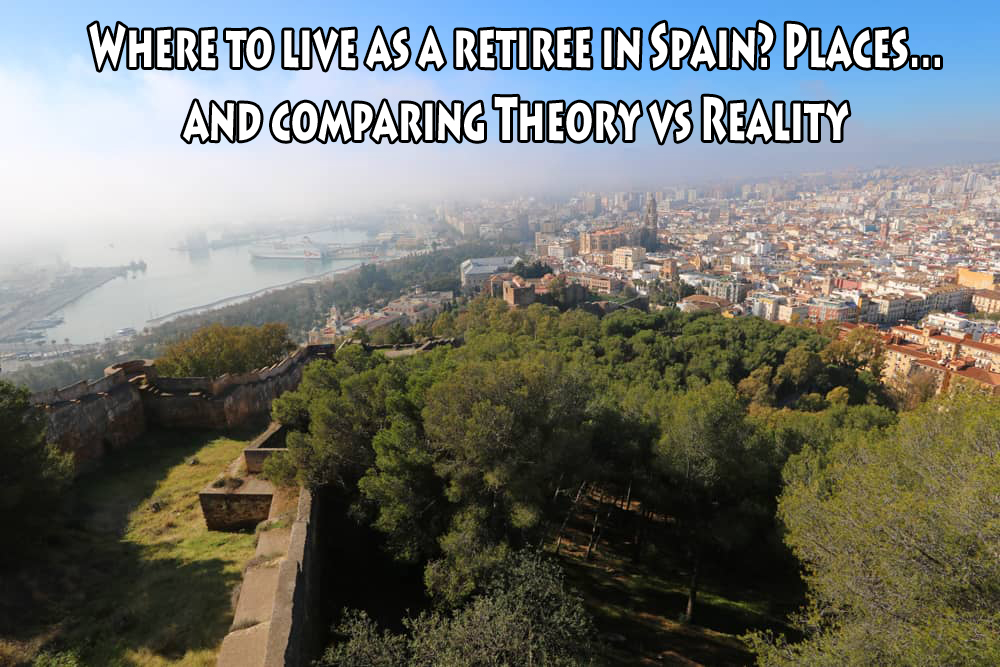

Related: Where to live as a retiree in Spain? Places…and comparing Theory vs Reality

Leave a Reply